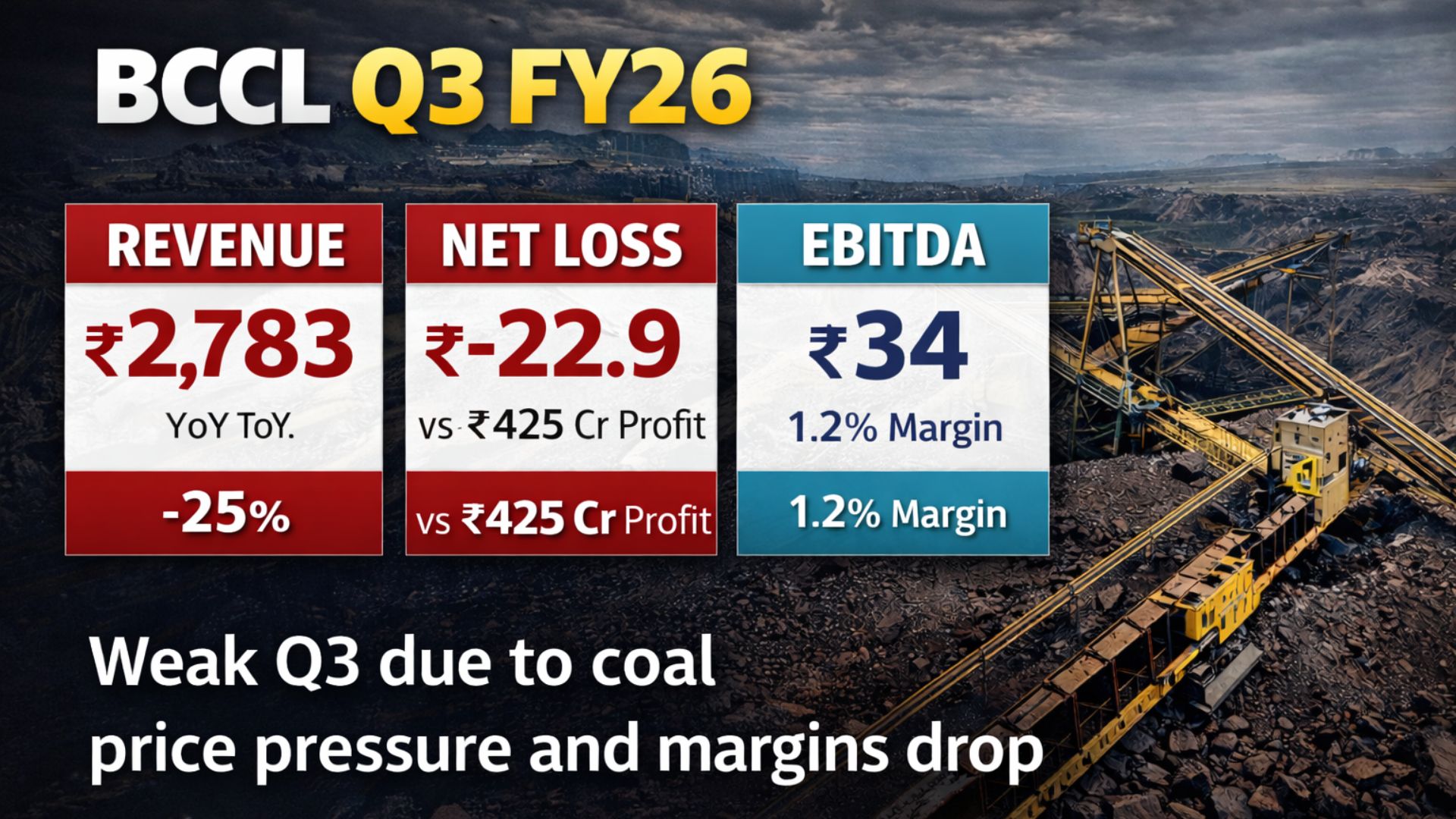

BCCL Q3 FY26: Net Loss Reported After Sharp Revenue, Margin Dip

Bharat Coking Coal Limited (BCCL) reported its Q3 FY26 financial results (for the quarter ended December 31, 2025), marking its first quarterly earnings since its market debut earlier this year. The company posted a net loss of ₹22.9 crore, a sharp reversal from a net profit of ₹425 crore in the same quarter last year, as top-line and operating performance weakened.

Revenue from operations declined about 25% year-on-year to ₹2,783 crore, down from ₹3,688 crore in Q3 FY25, reflecting softer coking coal realizations and subdued market demand. EBITDA plunged roughly 94% to around ₹34 crore, compressing margins significantly to near 1.2% from 15.3% a year ago.

The downturn in financials was accompanied by pressure on operational efficiency, with lower dispatches and reduced external auction gains weighing on revenue. Cost lines, including employee expenses, also increased marginally on a year-on-year basis.

BCCL’s share price reacted weakly to the earnings release, with trading sessions showing share price declines after the announcement. The company, a subsidiary of Coal India Ltd., has highlighted that these results came amid challenging market conditions in the coking coal segment. Investors will be watching management’s strategy on production optimization, sales execution, and margin recovery in the coming quarters.

Disclaimer: This content is for informational purposes only and should not be considered as investment advice. Please consult a financial advisor before making any investment decisions.

| Feature | Value |

|---|---|

| company | Bharat Coking Coal Ltd |

| quarter | Q3 FY26 |

| revenue cr | 2783 |

| revenue yoy percent | -25 |

| net profit loss cr | -22.9 |

| ebitda cr | 34 |

| ebitda margin percent | 1.2 |

| result summary | Weak quarter due to coal price pressure and margin contraction. |

| disclaimer | For information only. Not investment advice. |